Puget Sound First Quarter 2016 Healthcare Real Estate Overview

By Paul Carr, CCIM/MBA

First Vice President

CBRE

By Dang Nguyen

First Vice President

CBRE

Original Publish Date: May 10, 2016

MARKET OVERVIEW

Puget Sound healthcare real estate activity kicked off 2016 with a flurry of activity topped off by a record setting MOB sale on First Hill: Trammell Crow sold First Hill Medical Pavilion for $199 million, or $884 per square foot, an all time high for an office building in Seattle. In leasing, UW Medicine leased 24,984 SF at the Meridian Medical Pavilion in Northgate. Trend in leasing points toward strong demand for medical space between 1,500 SF and 3,000 SF, while demand is weaker between 3,000 – 8,000 SF. Opportunities over 10,000 SF with easy access, parking and great exposure are very desirable as well.

In new construction, Swedish is expected to break ground on their new towers on First Hill in Q3 2016. The project, expected to complete in the fall of 2019, will deliver two towers up to 17-stories each totaling up to 982,000 SF with 777 parking stalls. In addition, Healthcare Realty continues to move forward with the construction of the new 133,000 SF MOB adjacent to their First Hill Medical Building with a targeted delivery of mid-2018. This will create a 2-building campus of just over 200,000 sf. On Overlake’s campus, the hospital announced a 180,000 SF East Tower to be completed in 2023. The expansion will include a neonatal center, two surgical suites, lab space, patient rooms and respiratory care.

A NEW FOCUS ON ADMINISTRATIVE SPACE

WORKPLACE STRATEGY

In this discipline, the healthcare industry is lagging behind other industries. Companies – from media and technology to financial services and law firms – have acknowledged the fundamental role of the workplace in the competitive business environment, and are seeking a competitive advantage by creating workplace strategies that optimize efficiency, collaboration and creativity. Creative space has historically been reserved for entertainment and media firms, ad agencies, technology companies and other industries that rely on the creative class of workers as their core competency. The burgeoning demand for creative space has now extended into more traditional office environments, as real estate companies, financial firms, law firms and healthcare organizations have joined the fray. Many of these firms have demonstrated their seriousness about developing creative workplace strategies by eliminating the traditional cube environment and executive offices in favor of highly functional shared workplaces. These strategies focus on space optimization, increased collaboration, enhanced culture, employee wellness, and the ability to attract, engage and retain top talent.

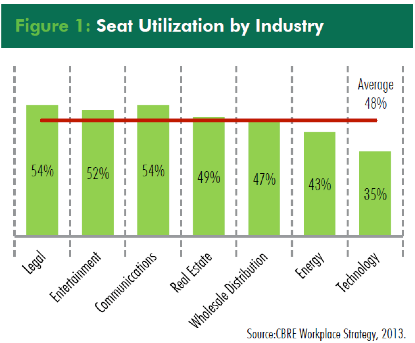

As shown above, on average, office space is only occupied roughly 48% of the time.

A CASE STUDY CLOSE TO HOME

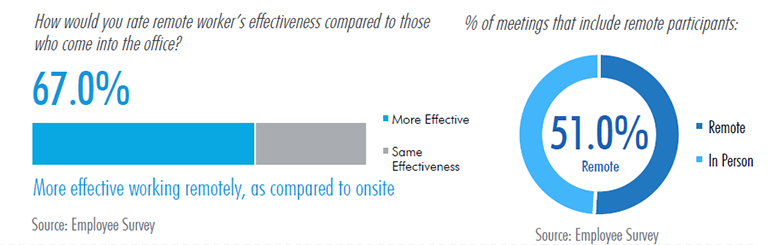

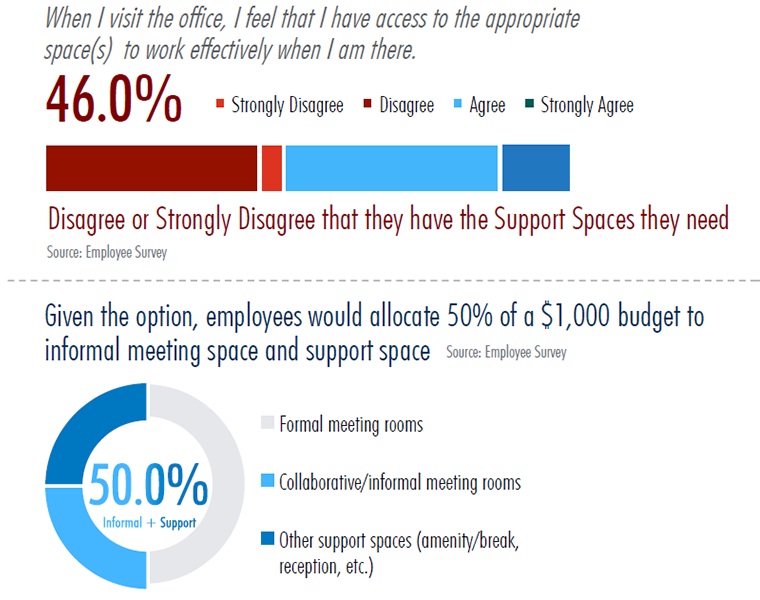

In 2013, ABC Healthcare System (Client name withheld for confidentiality) began its in-depth review of administrative space requirements and concluded that a space consolidation initiative was desperately needed not only to reduce occupancy costs, but also to improve space efficiency and employee satisfaction. Through a series of employee surveys, focus group discussion and executive interviews, the following findings were presented to the system’s executive leadership:

- There were significant discrepancies in quality and allocation of space

- A strong desire and need existed for more collaboration and improved support

- Employees wanted the option to be mobile

- Enclosed private spaces made up a high percentage of the overall office

- Employees were apprehensive and somewhat resistant to change

- The space was not conducive to productivity

Given the supporting data and ample feedback from employees, the end result was a solution that delivered a number of major changes. While everyone would continue to have a desk, office allocations were decreased from 25% to 10%. Collaboration and amenity space was increased and panel heights on workstations were reduced, creating a more modern and open feeling. All non-desk functions were equipped with laptops, and all conference rooms were reconfigured as plug-and-play.

CONCLUSION

When faced with an administrative space decision, leading healthcare executives have begun work with Workplace Strategy experts to incorporate more long-term planning approaches to collaboration and space efficiency. Modern tools and data-driven approaches are being used to create both real estate cost savings and a better workplace.

Carr has assisted with the leasing requirements for some of Seattle’s largest multi-specialty physician groups, the monetization of medical office buildings and excess land for a variety of regional and community hospital systems and the acquisition of medical office buildings for investors and physician groups alike. He has been with CBRE since 2001 and consistently ranks among the top CBRE Brokers in Washington State. He can be reached at paul.carr@cbre.com or 206-292-6005.

Dang Nguyen is a real estate professional with over 15 years of experience. He is currently a First Vice President, having recently joined CBRE’s Healthcare Properties team; the region’s only brokerage team dedicated 100% to healthcare real estate. Adding to the team’s existing expertise of transactional execution, Dang brings dedicated proficiency in strategic consulting and transaction advisory for corporate decision makers in the healthcare, technology and banking industries. He can be reached at dang.nguyen@cbre.com or 206-292-6026.