Tax Considerations in Analyzing Offers From Practice Groups

By Ralph Levy

Senior Partner, Health Law practice

Dickinson Wright

Original Publish Date: June 17, 2025

Although in prior articles in this publication, I addressed tax issues faced by physicians and other practice groups, the purpose of this article is to guide physicians and other medical professionals as they compare the taxes payable by them under completing offers to join practice groups. These tax consequences will vary depending on several factors, including whether the offer includes equity ownership and whether or not the group is organized as a professional corporation.

Suppose the offer is for employment without an ownership interest in the practice group, regardless of whether the employer is organized as a professional corporation (PC) or as a professional limited liability company (PLLC). In that case, the tax consequences of cash compensation paid to the employed professional will be the same. The hired professional will be taxed on all cash compensation, including bonuses at ordinary income rates, and Social Security and Medicare taxes will be deducted by the employer. Employees are responsible for Social Security taxes on all annual cash compensation of 6.2% up to the contribution and benefit base for that year ($176,100 for 2025). This means that the maximum Social Security taxes that the employed physician or other professional will pay is $10,918.20 for 2025. In addition, employees must pay Medicare taxes of 1.45% of all compensation paid and an additional Medicare tax of 0.9% on annual cash compensation paid in excess of $200,000 ($250,000 if the employed professional files a joint return). (Although fringe benefits provided by a practice group to an employed professional will be taxed differently to the employees of a PC than if provided by a PLLC, these differences are beyond the scope of this article.)

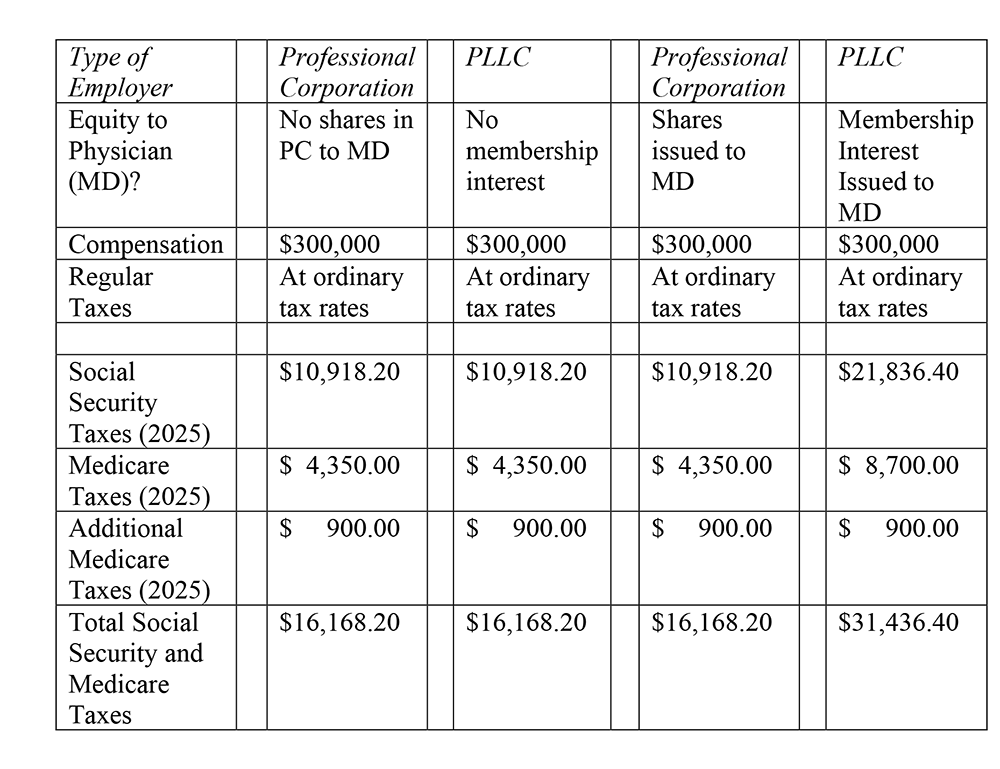

If the employment offer is from a practice group organized as a PC, and the physician or other professional becomes a shareholder of the PC upon employment, the cash compensation paid by the PC to the employed physician or other professional will be taxed in the same manner as if the employee did not own stock in the PC as described in the preceding paragraph of this article. (There will also be tax consequences to the employee-shareholder if the professional receives shares of stock in the PC that have a fair market value in excess of what the individual paid for the shares in the PC.) However, dividends paid by the PC to its shareholders will not be subject to Social Security or Medicare taxes since those taxes only apply to compensation for services. If the employment offer is from a practice group organized as a PLLC and the physician or other professional becomes a member of the PLLC upon employment, the compensation paid to the physician or other medical professional for services provided to the practice group is taxed as ordinary income. (As with the issuance of shares in a PC, if the physician or other professional receives an interest in a PLLC that has a fair market value in excess of the amount paid by the physician for such interest, the individual will be taxed on this difference.) Due to the PLLC ownership, all cash compensation paid for services will be treated as "guaranteed compensation" that is subject to Social Security taxes of 12.4% of the then applicable contribution and benefit base ($176,100 for 2025), to Medicare taxes of 2.9% and to the additional Medicare tax of 0.9% of annual cash compensation paid in excess of $200,000 ($250,000 if the employed professional files a joint return). This means that the professional will pay additional Social Security taxes of up to $10,918.20 (for 2025) and 1.45% of increased Medicare taxes if employed by a PLLC as compared to the Social Security and Medicare taxes that will be payable by the professional if employed by a PC. This additional tax cost will be partially offset by the ability to deduct the "extra" Social Security and Medicare taxes paid by the physician or other professional against the individual's other taxable income.

The differences in the tax consequences of the various types of employment offers are illustrated in the table below for a physician hired for base compensation of $300,000 per year. For simplicity purposes, the comparison below ignores any differences in the taxation of fringe benefits and assumes that the employed physician is single (does not file a joint return) and that no bonuses are paid above base salary. In this example, the physician will pay almost double the amount of Social Security taxes and Medicare taxes if part of a practice group organized as a PLLC in which the individual receives a membership interest on joining the group as compared to the employment taxes payable if the physician were employed by a PC (regardless of whether or not the physician becomes a shareholder of the PC).

A physician or other medical professional should consider the tax consequences of offers from different practice groups. Since physicians and other professionals who are members of a PLLC will pay significantly higher Social Security and Medicare taxes than they would if they join a practice group organized as a PC, a lower base compensation from a group organized as a PC may be better to the physician or other professional on an after-tax basis than a higher base compensation paid by a PLLC if both offers include the issuance of equity by the practice group upon joining the practice.

About the Author

Ralph Levy is a senior partner in the Health Law practice at Dickinson Wright. With over four decades of experience, he advises entrepreneurs and closely held businesses on operational, tax, succession, and estate planning matters. Ralph’s background includes serving as General Counsel for a national healthcare services provider, giving him practical insight into business operations and legal strategy. He regularly counsels boards, compliance committees, and executive leadership on internal investigations and compliance issues.