HHS Releases Provider Relief Fund Revised Reporting Requirements and Opens Portal

By Aparna Venkateswaran, Senior Manager, Health Care Assurance Services, Moss Adams

By Melaney Scott, Senior Manager, Health Care Consulting Practice, Moss Adams

By Georgia Green, Manager, Health Care Consulting Practice, Moss Adams

Original Publish Date: July 13, 2021

A slew of notable activity surrounding revised reporting requirements for the Provider Relief Fund (PRF) has occurred, including:

- The US Department of Health and Human Services (HHS) released revised reporting requirements on June 11, 2021

- The Health Resources & Services Administration (HRSA) released PRF Reporting Portal resources on June 30, 2021, and subsequently opened the portal

- HHS posted additional or modified Frequently Asked Questions (FAQs) for the PRF on July 1, 2021, collectively referred to as the PRF reporting guidance

The updates reflect significant changes to the prior guidance, including the deadlines to use and spend these funds and report expenses, lost revenue, and other data elements.

The first 90-day period of reporting begins on July 1, 2021, for providers who received and retained funds on or prior to June 30, 2020.

HRSA, who is hosting the portal, has issued a reporting user guide and portal worksheets to assist providers with the reporting process. To stay up-to-date, providers should continue to frequently monitor HHS guidance for clarifications and timing updates.

Below, we cover key changes to the PRF reporting guidance and outstanding questions.

Key Impacts

The update impacts PRF reporting in the following notable ways:

- Deadline for use of funds. HHS requires providers to use funds by a specific date based on when the payment was received.

- Deadline for reporting. HHS provides a three-month window after the deadline for use of funds has passed to complete reporting. The portal is now open for the first period of reporting.

- Inclusion of Skilled Nursing Facility (SNF) and Nursing Home Infection Control Distribution payments. HHS includes guidelines for reporting SNF and Nursing Home Infection Control Distributions, which began on August 27, 2020, and continued through February 12, 2021.

- Expenses reported on a quarterly basis. The new guidance specifies that expenses will be reported in quarterly increments, rather than for the full calendar year.

- Other Assistance Received reported by quarter. The requirement to report Other Assistance Received, such as Paycheck Protection Program, Federal Emergency Management Agency (FEMA), and COVID-19-testing funding, remains the same; however, these will now be reported by quarter.

- Return of unused funds. Per the FAQs, unused funds will have to be returned within 30 calendar days after the end of each reporting period. The PRF reporting guidance indicates the portal has a mechanism to initiate the return of unused funds.

Phased Schedule for Funds Use and Reporting

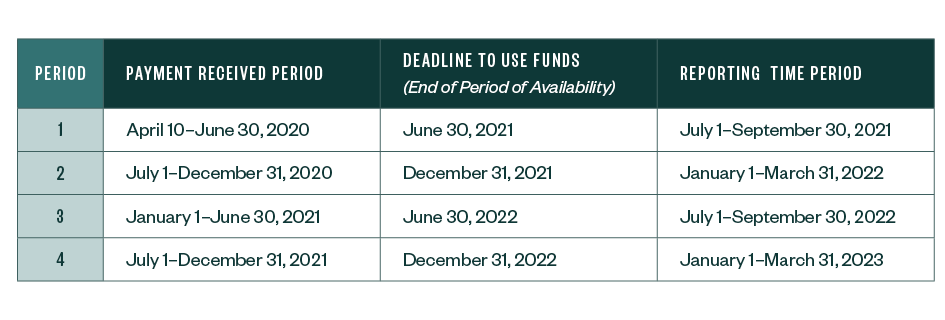

HHS outlined a four-period approach to the use of funds, referred to as the period of availability. Reporting on the use of the funds is required to be completed during a three-month window subsequent to the end of each period of availability.

Period of Availability and Deadline to Use Funds

Providers must now demonstrate that the funds were used for eligible expenses and lost revenue during a period of availability. The period of availability is determined by the date the provider receives payment.

Payment Schedule and Deadlines

Reporting Deadlines

Providers that received and retained one or more payments exceeding $10,000 in the aggregate during a payment received period are now required to report on the use of those funds within 90 days immediately following the end of the period of availability.

Providers that don’t submit their reporting within the respective reporting period are considered out of compliance with the PRF terms and conditions and may be subject to recoupment. Providers will have to report in multiple reporting periods depending on the timing of when payments were originally received.

SNF and Nursing Home Infection Control Distribution Reporting

HHS incorporated reporting requirements for the General, Targeted, and SNF and Nursing Home Infection Control Distributions into one set of reporting requirements with the issuance of the updated reporting guidelines notice.

Providers will submit information that distinguishes the use of the SNF and Nursing Home Infection Control Distributions from the other distributions.

The terms and conditions of the SNF and Nursing Home Infection Control Distributions outline specific eligible expenses. Therefore, the SNF and Nursing Home Infection Control Distributions can only be applied against those eligible expenses and can’t be applied against lost revenue.

Not to be confused with the SNF Distribution on May 22, 2020, these distributions were made on August 27, 2020, and later, and therefore won’t be included in the first reporting period.

Quarterly Expense, Revenue, Other Assistance Reporting

Below is additional information about expenses, lost revenue, other assistance, and unused funds.

Expenses

While the categories of expenses remain the same, HHS now requires quarterly reporting during each period of availability.

Based on the PRF reporting guidelines, SNF and Nursing Home Infection Controls expenses will be reported separately from the General and Targeted Distribution expenses.

If PRF funds are fully utilized through expenses, the reporting guidelines indicate that recipients won’t have to report lost revenue; however, recipients must report revenue for calendar year 2019 and 2020, by payer, by quarter.

Other Assistance Received

Prior reporting guidelines included the requirement to report Other Assistance Received. The PRF reporting guidelines shifted around the order of information to be reported.

One of the items shifted to the top of the ordering is Other Assistance Received. The categories of assistance remain the same; however, the requirement to report quarterly amounts is new.

Lost Revenues

If PRF funds aren’t fully utilized through expenses, providers will need to report lost revenues. Providers still have three methods to report lost revenues, which are listed as:

- Actual to actual. The Reporting Portal User Guide (User Guide) refers to this option as 2019 Actual Revenue.

- Budget to actual. Referred to as 2020 Budgeted Revenue in the User Guide.

- Alternate Reasonable Methodology

The calculation of lost revenues for the first period of availability will be on a calendar quarter basis from the period of January 1, 2020 through June 30, 2021, and the baseline period will be either:

- 2019 calendar quarters, if using option one

- 2020 calendar quarters, if using option two

Providers that use option two will need to submit their 2020 budget that was established and approved prior to March 27, 2020, and an attestation by an executive officer—CEO, CFO or similar responsibility—attesting to the accuracy of the budget submitted.

Providers that use option three will need to submit:

- A narrative document that describes the methodology used

- An explanation of why the methodology is reasonable

- A description of how lost revenues were attributable to COVID-19

- The calculation of the lost revenues

- Any additional supporting documentation that may be appropriate

The PRF reporting guidance indicates a zero will be displayed in any quarter where there is a positive change in revenue if using option one or option two.

Unused Funds

During any period, if an entity doesn’t have allowable expenses and lost revenues to demonstrate full utilization of the funds, the unused amount will need to be returned.

PRF reporting guidance indicates there will be a method to initiate the return of unused funds through the reporting portal and recipients have 30 days after the end of each reporting period to return unused funds.

Outstanding Questions

While the PRF reporting guidance provides directional insight, there are still questions remaining about the practical implementation of the reporting process.

Overlapping Periods of Availability

Each period has overlapping time frames that funds can be used. For example, the time frame to apply funds in period one is April 10, 2020, through June 30, 2021.

The timeframe to apply funds in period two is July 1, 2020, through December 31, 2021. Thus, there’s an overlap between the two periods of July 1, 2020 through June 30, 2021.

It’s unclear if the reporting portal for each subsequent period will retain information previously submitted or require resubmission of data.

It’s also unclear if the reporting portal will have a mechanism to clearly demonstrate expenses aren’t applied to more than one period—for instance, considering the no double dipping concept—but this will be something to document and track internally.

HHS did make note that expenses could be incurred prior to the receipt of funds, but wouldn’t expect them prior to January 1, 2020.

Excess Expenses and Lost Revenue

It’s unclear if there will be a roll-forward mechanism in the reporting portal for entities with expenses and lost revenues in excess of the amount of PRF received in a period to apply to the next reporting period.

Retroactive Revision of Reporting

Should an organization receive funds from another source related to expenses included in a PRF reporting period, it’s unclear how this updated information would be reported.

An example where this could occur is with FEMA funds, when an award letter isn’t received until after an entity reports on the use of PRF funds.

Since the FEMA funds would provide duplicate reimbursement for the PRF expenses previously reported, it would be necessary to revise the prior PRF reporting in order to accept the FEMA funds.

Updated Guidance on SEFA and Single Audit/Financial Related Audit of Funds

Current guidance regarding Schedule of Federal Awards of Federal Assistance (SEFA) and Single Audit/financial related audit of the PRF are now misaligned with the June 11, 2021 PRF Reporting Guidelines.

Updated guidance for SEFA preparation and timing of and performing the Single Audit/financial related audit is expected.

We’re Here to Help

To learn more about the potential impacts on your PRF payments or reporting, contact your Moss Adams professional.

The information in this article is based on the latest guidance available as of July 2, 2021. We encourage you to visit the HHS Provider Relief Fund website for the most up-to-date information.

Aparna Venkateswaran has been in public accounting since 2004. She provides assurance services primarily to the health care industry, including Knox-Keene-licensed health plans, hospital systems, medical groups, and others. She can be reached at (949) 517-9473 or aparna.venkateswaran@mossadams.com.

Melaney Scott has provided compliance, regulatory, and internal audit services since 2007 as well as accounting and finance work since 1999. She serves a variety of health care clients, including governments, not-for-profits, tribal entities, and private businesses. She can be reached at (253) 284-5228 or melaney.scott@mossadams.com.

Georgia Green has worked in the health care industry since 2011. She provides strategic and operational consulting services to health care providers and payers and has extensive experience helping clients integrate value-based care models from start to finish. She can be reached at (916) 503-8251 or georgia.green@mossadams.com.

Assurance, tax, and consulting offered through Moss Adams LLP. Investment advisory services offered through Moss Adams Wealth Advisors LLC.