How Deal-Makers Are Capitalizing on Health Care Analytics

By Karl Rebay

By Karl RebayDirector, Health Care Consulting, Moss Adams

By Jeff McDonald

CEO and Founder, Expression Health Analytics

By Dana Goldberg

Head of Research and Strategy, Expression Health Analytics

Original Publish Date: August 8, 2017

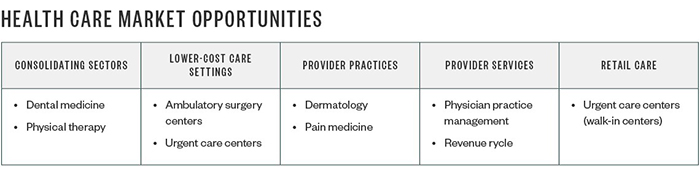

It’s an active time for investments in the health care sector, despite an uncertain and ever-changing landscape. Investors are becoming more selective, which means stakeholders must balance their need for speed to market with informed, subjective decisions. Health care investors who rely on traditional approaches for conducting due diligence may be leaving opportunities on the table and putting themselves at a competitive disadvantage, but thanks to new approaches like investment-grade health care analytics, investors can now understand the true value of a health care investment.

The information available for health sector opportunities is fairly consistent but sometimes elusive. For example, it’s important to understand provider alignment as well as referral network patterns and strength to fully appreciate an organization’s true competitive position, market opportunity, and provider and customer loyalty. Some of the recent and emerging changes in health care make it more difficult to have the right information for sound investment decisions.

Health Care Is Complicated

Changes in the health care arena come from multiple angles, including:

- Shifting reimbursement models

- The aging population

- Clinical and technology innovation

- Rising rates of chronic diseases

- Growing consumerism

- Shifting services from inpatient to outpatient settings

As services migrate from inpatient to outpatient hospital settings and retail settings, new investment potential is created, making critical insights more important than ever. Outpatient data is among the most elusive data for investors to secure. Even hospitals with sophisticated data systems typically have a blind spot when it comes to what happens outside their facility walls. For example, when trying to evaluate an opportunity for stand-alone urgent care centers, outpatient diagnostic imaging, or physician practices that are affiliated with a hospital, internal data is often readily available but external market data isn’t.

Without in-depth market intelligence, stakeholders don’t know what they don’t know. It’s commonly accepted that traditional due diligence often involves verifying or confirming information rather than discovering opportunities. However, the 2010 McKinsey & Company survey on deal-makers and other more recent studies indicate that due diligence is inadequate in more than 40% of deals.

Most outpatient providers don’t have the time, capability, or access to the necessary information for high-performing due diligence. Without hard data, organizations may have an overly optimistic view of circumstances or, worse, pass on a great opportunity.

Recent strides in market-utilization analytics enable investors to choose the best investment based on information that was previously unavailable.

A Balancing Act: The Need for Speed and Sound Due Diligence

To take advantage of the considerable arbitrage opportunities in the health care sector, time to value is critical. At the same time, stakeholders must use a defined, objective framework for due diligence.

Analytics can be a strategic differentiator in these cases. By using analytics during all phases of portfolio management, stakeholders can find value beyond the information that’s available using traditional methods:

- More quickly identify new business opportunities, including new sectors, geographic markets, and organizations

- More quickly understand market levers, trends, and impact

- Conduct faster, more complete due diligence

- More accurately analyze competition and competitive positioning

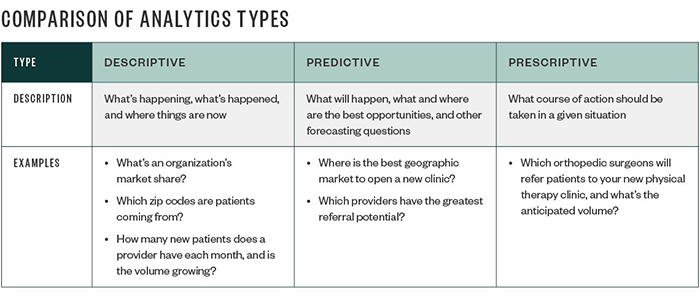

Descriptive, Predictive, and Prescriptive Analytics

Investors can forecast growth in business by using descriptive, predictive, and prescriptive analytics to determine the course of action to take to successfully increase provider referrals or provide new services. These analytics can also give stakeholders a more holistic understanding of markets and health sectors, so they can quickly discover the best targets for investments based on actual performance and calculated potential value.

Here’s a brief overview of the three types of analytics available to improve the due diligence process for better investment decisions.

High-Level View

Analytics users can quickly identify attractive markets or compare markets to find the right set of conditions for investment, such as:

- Degree of fragmentation or consolidation

- Number of providers in a market

- Extent of unmet need

- Demographic conditions that are favorable to a particular sector

- Patient migration

Detailed View

At a more detailed level, analytics can also show all the providers in a particular market, where they’re located, and their market share. This detailed information can help fill out an investor’s market view:

- Number and type of physicians and their medical specialties, such as cardiologists and orthopedic surgeons

- Different settings where care is provided, such as hospitals, physician practices, and ambulatory surgery centers

From this view, analytics can help stakeholders understand what’s occurring within an organization or provider’s practice by using objective measures, such as:

- Volume of patients

- Number of specific valuable procedures performed

- Surgical conversion rates

- Patient demographics and diagnoses

- Payer mix

Other measurable indicators include the alignment of practitioners to specific organizations and the strength and diversity of a provider’s referral network.

Claims-Based Market Analytics

Analytics can be used to provide answers to specific market questions:

- What’s the market opportunity?

- What’s the potential for new growth, and what’s the size of unmet needs?

- How large is the referral network and what value does that represent?

- Is there a competitive risk due to new entrants or sectors?

Case Study: Assessing Ambulatory Surgery Opportunities

A hospital system was considering opportunities for joint venture investments in ambulatory surgery centers. The system had an ownership interest in one center, but there was concern because of a decline in patient volume that had generated a financial loss. The hospital system’s investment goals included:

- Lowering the risk of its investment

- Speeding time to market

- Quantifying the surgical conversion rate from key referral sources

- Understanding provider alignment and upstream referral potential

- Quantifying the surgery potential and volume for discrete procedures

- Quantifying patient outmigration

As part of the investment exploration, a detailed market and volume analysis was conducted. Using internal data, physician surgical volume and contribution-to-revenue trends were assessed. A market assessment was performed using claims analytics to determine the following:

- Extent of patient migration, which represented lost opportunity for the hospital system

- Total market volume for surgical procedures

- Provider alignment to both ambulatory surgery centers and competing hospital systems

- Identification and value of additional surgeries that could be performed in an ambulatory surgery center setting

Using analytics, the hospital system was able to efficiently and quickly discover the critical market dynamics needed to assess the available opportunities and address each goal.

A Better Way to Make Investment Decisions

The opportunity to conduct thorough due diligence with both speed and increased insight is possible through the use of market analytics that provide actionable insights into metrics that matter. When the stakes are high, identifying subjective, measurable, and deep insights based on current, complete market data provides a strong competitive advantage.

We're Here to Help

For more information on how market analytics can help your health care organization grow, contact your Moss Adams professional.

Karl Rebay has built consulting, finance, and operational experience in the health care arena since 1994. He leverages his expertise in strategic business planning and provider operations to help health care organizations succeed in the current market. He can be reached at (949) 623-4193 or karl.rebay@mossadams.com.

Jeff McDonald has over 20 years of experience in technology, innovation, and analytics. By providing insight to health care providers, he enables them to better understand and predict changes in the market in order to execute their vision with greater success. He can be reached at jmcdonald@expressionhealth.com.

Dana Goldberg helps to discover, build, and grow client and partner relationships. She has spent her career in healthcare with positions and experience in strategic planning to marketing, physician development to product development. She can be reached at dgoldberg@expressionhealth.com.