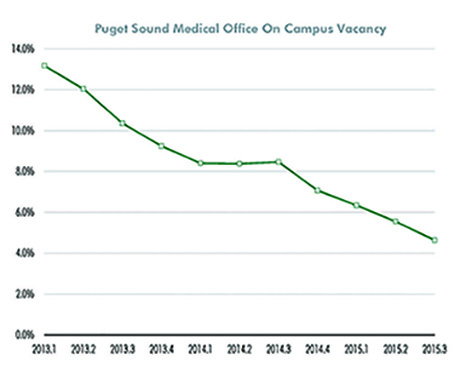

Puget Sound Medical Office On Campus Vacancy Rate Plummets to 4.63%

By Paul Carr CCIM/MBA

First Vice President

CBRE

Read PDF of this article See all this Month's Articles

Original Publish Date: October 2, 2015

From the Dow Jones Industrial Average to the unemployment rate or even the Farmer’s Almanac, everyone seems to have his or her own favorite leading economic indicator. My new favorite is the Seattle Crane Index. Twice a year (starting 18 months ago), construction consulting company Rider Levett Bucknall counts the construction cranes in the City of Seattle and issues a Crane Index. Surprisingly, the most recent index, published in July, indicates a reduction in cranes from the January index, from 51 to 42. Personally I have not noticed the reduction. Maybe that is due to the heavy concentration in the South Lake Union area near my office: 13 cranes. Or maybe I have not noticed the downward trend due to the contradictory indicator of vacancy rates in my world of medical office space.

Our 3Q15 quarterly medical office building survey of vacancies and lease rates in larger on- and off-campus properties from Edmonds to Olympia shows a continuing trend of vacancy rates tightening in the most desirable medical office space on or very near busy hospitals.

As depicted in this chart the current vacancy rate for on campus medical office buildings in the Puget Sound region is 4.63%, down from 13.18% in the first quarter of 2013 (1Q13). When the vacancy rate in an area falls below 5%, it is time to bring in the cranes to meet the demand.

Medical office space is rarely brought to market on a purely speculative basis. Developers typically need medical office tenants to commit in advance in order to kick off new projects. If you are a larger medical office tenant needing to expand or enter one of these tight submarkets, be prepared to pre-lease a planned project before construction begins, and make sure to start these conversations two to three years before you need to open for business.

Below I describe some potentially crane-worthy hot spots in western Washington. While not a comprehensive list, they are examples of markets where tenants will struggle to find adequate medical office space before new product is built.

Seattle – First Hill

In the largest concentration of medical office properties in the state on First Hill in Seattle, the vacancy rate has dropped to an unprecedented 1%. On-campus medical office lease rates have steadily ticked up from $29 NNN eighteen months ago, to $33 NNN - $38 NNN today...if a space can be found. Swedish/First Hill recently presented a two building project design to the Standing Advisory Committee for its Major Institution Master Plan. Based on the plan, it is reasonable to surmise that one tower will be inpatient focused and the other outpatient focused. Both the inpatient and the outpatient towers would be located in the heart of the hospital campus and are being designed to be the tallest buildings on campus. While it is possible that the hospital would lease space to third parties in the outpatient medical office building, it is more likely that they would occupy both towers entirely. Whether or not this will create vacancies in buildings that Swedish currently leases remains to be seen, but any loosening in this very tight market would not occur for several years at the earliest. In the meantime, tenants will struggle to expand or enter the First Hill area if they want quality medical office space until a new medical office building is delivered.

Seattle – Ballard

The on campus submarket around Swedish Ballard has also seen a dramatic drop in vacancy. Vacancy rates have gone from 14% in 1Q13 to 3.28% today. Tenants are responding by looking for nearby high exposure locations with good access and parking to serve the growing Ballard and surrounding neighborhoods.

Seattle – North Seattle

UW/Northwest Hospital has a self-contained campus, surrounded by an area that is not developable for new medical office buildings, so practices and physicians supporting this hospital must locate in the area from the intersection of Meridian and Northgate Way (Meridian Medical Pavilion) to the UW’s outpatient building or leapfrog into the Northgate Mall area. The Meridian Medical Pavilion, the nicest and newest medical office building off campus has been 100% full for many years but may have a full floor coming available with high exposure building signage. Strong interest is lining up even before the space is officially available. There are also rumors of a large office to medical office conversion near Northgate Mall that would be 100% occupied by a single tenant.

Bellevue

Overlake Hospital and Medical Center, in Bellevue, has also seen a tightening in the medical office market around campus. Vacancy rates on campus have dropped from 47.24% in 1Q13 to 24.03% today. The Overlake Medical Pavilion, the newest and highest image building in this submarket, has been steadily filling up with only four more suites available, two on upper floors and two on lower floors.

Edmonds

Medical office is also in short supply on the Swedish Edmonds campus, with the vacancy rate now at less than 1% down from 13.62% in 1Q13. Key components of the supply in the surrounding submarket, the Edmonds Medical Plaza and Edmonds Medical Pavilion buildings have only one small space remaining between the two. Tenants in the market for a surgery center may appreciate the one space available at the 76 Professional Commons, which contains an up-to-date operating room.

Renton

There has been no space available on the UW Valley Medical Center campus for well over two years so tenants all look at nearby medical office buildings. IDC Medical Plaza, exactly one mile from Valley Medical Center, is the only Class A off campus medical office building in this submarket with good exposure and access. Vacancy in the submarket including off campus buildings has gone from 10.64% to3.84%. Currently only two spaces are available at IDC. Rumors are that leases terms have been finalized with an anchor tenant to kick off a new MOB across the street from Valley Medical Center, but not on the site with the big “coming soon” sign. Check future issues of this magazine or future issues of the CBRE Healthcare Properties Market Insight Report for more details.

Issaquah

The medical office properties on and adjacent to the Swedish campus are 100% occupied. Adjacent to campus, Proliance added 9,000 sf to their building and complete filled the space with their own uses. Swedish is rumored to be planning an additional medical office tower to satisfy excess demand on campus.

Summary

The medical office squeeze correlates to the population boom the area is experiencing. The Puget Sound Business Journal reported the following on September 18 in “Feeling crowded: Seattle area adds 61,373 residents in a year”: “The Seattle-Tacoma-Bellevue area added 61,373 residents last year, making it the nation’s 11th fastest-growing large urban area, according to new census data.

With tech and aerospace jobs pushing the jobless rate below 5 percent, the metro area population swelled last year by 1.7 percent, to 3,671,478.” The state’s population has now grown to over 7,000,000.

In addition, hospital jobs have been increasing over the past year, with 122,800 new hospital jobs filled nationally, after a no-growth period following the recession. According to FierceHealthcare, (August 9, by Ron Shinkman), in 2013 no new hospital jobs were added. Hospitals now employ a total of 4.9 million people, out of 15.1 million in the healthcare sector as a whole.

Bring on the cranes!

Paul Carr is a First Vice President with CBRE, focusing on investment sales and leasing transactions within the healthcare sector of commercial real estate. As a member CBRE’s national healthcare services team, Carr advises physician groups, hospitals and investors on leasing, acquisition, disposition and build-to-suit development requirements.

Carr has assisted with the leasing requirements for some of Seattle’s largest multi-specialty physician groups, the monetization of medical office buildings and excess land for a variety of regional and community hospital systems and the acquisition of medical office buildings for investors and physician groups alike. He has been with CBRE since 2001 and consistently ranks among the top CBRE Brokers in Washington State. He can be reached at paul.carr@cbre.com or 206-292-6005.